What is CBP Form 3461?

Importance of CBP Form

If your business ships goods to the United States, you’ll likely be familiar with Form 3461. If you’re exporting to the US for the first time, you soon will be familiar with this critical shipping document.

While its name is far from catchy, CBP Form 3461 is extremely useful if you are importing freight into the United States. Also known as the Customs Release form, 3461 can be used to speed up the release of goods entering the US by air or sea.

What Purpose Does Form 3461 Serve?

The information on the form helps US Customs and Border Protection (CBP) officials decide whether freight entering the country should be handed over to the consignee or whether it should first undergo a customs inspection.

Who Needs To Fill-In Form 3461

Form 3461 is completed and submitted to customs officials at the port of arrival by the importer via email. However, if customs officials tell the importer they wish to see printed copies of shipping documents, Form 3461 cannot be used.

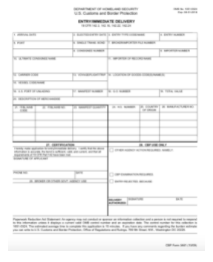

What Does Form 3461 Look Like?

Here’s an example of Form 3461:

Some of the key bits of information the importer is required to supply include:

- The date when the goods are expected to arrive in the United States

- The port of arrival

- The name of the consignee

- A description of the merchandise being imported

Let’s take a look at these and other Form 3461 requirements in more detail:

The Key Details Required on Form 3461

As with all shipping documentation, accuracy is crucial. Any discrepancies between the information recorded on CBP Form 3461 and the goods that US customs officials inspect could result in a delay in the goods being released. Here is some further information about the key details that the importer needs to supply on the customs release form.

Arrival Date

This is the date on which the conveyance—be it an aircraft or ocean vessel—arrives at the port or airport of discharge.

Port Reference Number

Every port and airport in the United States has a unique 4-digit code. The importer must enter the code of the port where the goods are to be unloaded.

Consignee Name and Number

The name of the consignee and their social security or IRS number must be provided on the form.

Importer Number

If the importer is different from the consignee, their social security or IRS number must be provided on the form.

Carrier Code

If the goods are arriving in the United States by air, the IATA code of the airline transporting the goods into the US must be provided. In the case of goods arriving in the US via connecting flights, only the IATA code of the airline responsible for the last leg of the journey to the US needs to be provided. For goods transported into the US by sea, the sea carrier code must be supplied.

Voyage or Flight Reference Number

The voyage, flight, or trip number of the carrier bringing the goods into the United States must be included on Form 3461.

Location of Goods

This section of the customs release form should detail the location in the port of arrival where the goods are awaiting release to the importer/consignee.

United States Port of Lading

The 4-digit code of the US port or airport where the goods are to be unloaded must be supplied.

Total Value

This area of Form 3461 must record the value of the shipment in US dollars. The total should match the amount on the Shipping Invoice.

Description

The importer is required to give a short description of the nature of the freight being imported. The size, weight, and dimensions of the goods should be outlined.

Country of Origin

The form requires the 2-character ISO code of the country of origin of the goods. The country of origin is defined as the territory where the goods were manufactured, produced, or grown.

Why Form 3461 is Important to Shipping in the United States

In 2018, the total value of imports into the United States exceeded $2.6 billion. That year, over 4,500 different types of products arrived in the US from 223 countries.

That’s a lot of imports, each of which is subject to customs checks at the port or airport of arrival. In the United States, those checks are carried out by the CBP, the US Customs and Border Protection unit. Form 3461 enables the CBP to release cargo to consignees more quickly, speeding up the processing of imports.

What Role Do US Customs and Border Protection Play?

The United States has 328 ports and more than 5,000 public airports through which goods from all over the world can potentially enter the country. Responsibility for providing border security services at these locations lies with CBP, one of the world’s biggest law enforcement agencies with over 60,000 employees. Its broad remit includes counterterrorism and anti-trafficking. In terms of international trade, its role is to:

- Promote the USA’s prosperity through trade competitiveness on a global stage

- Enable legitimate trade

- Collect import duties

- Examine cargo arriving in the United States to ensure it can legally enter the country

- Enforce laws, rules, and regulations regarding the import and export of commercial goods

- Guide shippers and carriers regarding compliance with these laws, rules, and regulations

How Does Form 3461 Differ From Form 7501?

International shipping requires many discrete documents to be submitted to officials at borders. Forms 3461 and 7501 are two of the most important for goods inbound to the United States.

The difference between the two shipping documents is that Form 3461 is used to help customs officials decide whether imported goods can be released to the consignee at the port of arrival. Hence the form’s alternative name of Customs Release form.

Form 7501 (also known as the Customs Entry form) goes into more detail about the nature of a consignment. It’s used to calculate the duty payable on a shipment. You can learn about this form in detail by reading our article on the Form 7501 topic.

CBP Form 3461—Digitally Speeding Up Imports to the United States

The customs release form is designed to make the shipping process in the US quicker and easier. Importers email the document to customs teams at the port of arrival. They use the information on the form to decide whether to release the freight to the consignee or carry out further checks. By removing some of the reliance on paper documentation from the shipping process, Form 3461 supports the shipping industry’s gradual move to more environmentally friendly processes and procedures.