Export Declarations in International Shipping

Shipa Freight Article Export Declaration

Nations across the world like to keep track of the nature and number of exports leaving their shores. An effective way to do this is to mandate shippers to provide details of the items they are exporting.

This information is usually supplied by the shipper or their freight forwarder on an export declaration form, which can be completed on paper or online, depending on the country the goods are exported from.

What is an Export Declaration form?

An export declaration form is a shipping document containing information about the goods a shipper wishes to export. The details required on the form include:

- The nature of the goods to be exported

- The number of goods being exported

- The value of those goods

Why is an Export Declaration Required?

Customs officials in the country of export use the information on the declaration form to help track and control the level and nature of exports. The details on the form will also be used to compile data about that country’s export trade. These statistics often feature in trade and export reports commissioned or compiled by governments.

Key Information Required on an Export Declaration

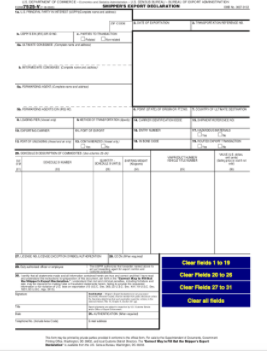

We’ve included a sample of a Shipper’s Export Declaration (SED) used in the United States further down this page. Most export declaration forms used around the world follow a similar format.

Key details that must be supplied on the SED (when exporting from the USA) include:

- The name and address of the person/business exporting the goods.

- The business’ nine-digit Employer Identification Number.

- The name and address of the person/business receiving the goods.

- An International Transaction Number (ITN). This can be obtained from US Customs via the automated export system (AES). We include more detail about this below.

- The state in the USA from which the goods are being picked up and taken to port.

- The Schedule B number; a ten-digit code that identifies the nature of products being exported.

Whether the goods being exported are:

- Domestic (D) – produced in the USA

- Foreign (F) – goods that entered the USA and are being exported to a different country without having been altered while in the USA

- Military (M) - goods that are being exported to a foreign government for use by that government’s military

- The country to which the freight is being exported.

- The method of transportation being used to ship the goods.

- The port of origin and port of arrival.

- The quantity and weight of goods being exported.

- The value of the goods. If your consignment is valued below $2,500, you may not need to complete an export declaration form.

- Export License Number—this permits the export of specific goods to certain destinations by the license holder.

Where is an Export Declaration Required?

Export procedures vary from country to country, so the following is a brief overview of the export declaration procedures in four key territories:

Exporting From the USA

The exporter or shipper must submit an export declaration form at the port from which the goods are being exported. Alternatively, a freight forwarder can complete the form on the shipper’s behalf, if authorized to do so via the granting of a power of attorney.

An export declaration form is required for shipments that meet the following criteria:

- The commodities in the shipment are valued at a total sum of more than $2,500.

- Postal shipments valued at $500 or more.

- The shipment requires an export license (regardless of the goods’ value).

- The shipment is bound for an embargoed country.

Exporting From the European Union (EU)

A similar procedure to that used in the United States is required for goods with an invoice value that exceeds €1,000.

Exporting From China

Enterprises seeking to export from China must apply and be approved to become an exporter by the Ministry of Commerce. Individuals or companies must also register with their local foreign trade department to gain foreign trade company status. Once that status is attained, a company will have a license to export that’s applicable to every shipment. There is no need to submit a new license with each shipment.

Exporting From India

To export from India, companies must obtain and file an Importer-Exporter Code which they can do online.

How To Submit an Export Declaration

The vast majority of export declarations must be submitted digitally. Most countries have, by law, abolished paper-based export declarations. However, this is only a recent phenomenon for some nations, including Canada, which only stopped accepting paper export declarations in June 2020.

Verbal declarations can also be made at the port of export, depending on the value of the goods, and many countries now accept digital export declarations. In the USA, digital filing is mandatory.

Digitized Export Declaration: The US Automated Export System (AES)

The aim of phasing out paper documentation is leading to the digitization of many shipping processes. This trend has seen the USA introduce the Automated Export System (AES) to replace paper-based SEDs.

US customs authorities discovered that many paper SEDs contained errors and were not easy to use to compile statistics for the US government. In response, the Census Bureau established the AES. Since September, 2008, it has been compulsory to file export declarations via this method.

Shippers exporting from the United States must submit an Electronic Export Information form (EEI) if the value of commodities within a shipment exceeds $2,500. Many freight forwarders and international couriers will prepare an EEI for shippers for a small fee, although enterprises can submit printed EEI’s themselves. Failing to file through AES, or submitting inaccurate details, carries a maximum fine of $10,000.

What Happens to the Export Declaration?

Although many shipping documents travel with the shipment to its destination, the export declaration form remains in the country of origin. The shipper or freight forwarder will deliver the form to the airline or ocean carrier, which will then pass or email the form to the customs authority at the port of export.

Sample of a Shipper’s Export Declaration (SED) Form

Export Declarations: For Government Use Only

The export declaration form is a typical example of a shipping document that’s gradually being digitized. The form is of limited use to the shipper or consignee. Its chief purpose is to provide vital information to customs officials and the government in the country of export, helping them to:

- Track and control the nature of goods being exported from their ports and airports

- Compile reports based on the data captured

So, while shippers will have limited interest in the contents of the form, an export declaration is likely to be of great interest to customs officials and trade-based government authorities. That’s why—as with all shipping documents—it’s vital that you ensure full and accurate completion of your SEDs, whether you submit them on paper or electronically.