CBP Form 7501 For Freight Imports to the United States

All about CBP Form 7501

The United States imported over $2.6 billion of goods in 2018. Such a huge amount of incoming commercial freight every year gives US Customs and Border Protection (CBP) officials at US ports and airports plenty of work. They inspect imported cargo, ensuring it complies with US laws, customs rules and regulations. They also decide if import duties need to be applied and collected.

To make their operations more efficient, CBP has created various forms that importers must fill out. One of these is CBP Form 7501. Also known as the Entry Summary, form 7501 is essential for all imports arriving in the US by air or ocean. It is not required or used in any other country.

What is the CBP Form 7501 For Freight?

The CBP Form 7501 is five pages long, but don’t be put off by that. Four of those pages are continuation sheets that give you extra room to provide in-depth details such as:

- Descriptions of the products being imported

- The value of the goods

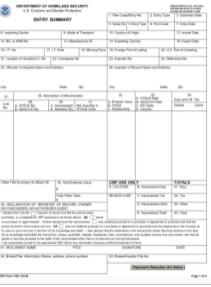

The main page of the form has 44 fields that need to be filled in. Here’s a sample of that page:

Who Fills in An Entry Summary Form?

CBP Form 7501 is usually completed and filed by a customs broker. But the shipper and importer need to know the information required on the form, as the broker is likely to ask them to supply some of it. Two copies of the form are required, the importer’s copy and the permit copy.

Key Information Required on the Entry Summary Form

A lot of information is required on Form 7501, including:

Entry Number

This is an 11-digit number that’s a unique number assigned to the freight by the customs broker or importer.

Port Code

Every airport and seaport in the United States is represented by a 4-digit code. The form must include the code of the US port where the goods were unloaded.

Information about port codes and many of the other codes that are required on Form 7501 can be found on the CBP Form entry summary instructions, and the CBP website.

Entry Date

This is the date on which the goods were released by CBP to the importer/consignee.

Country of Origin

This refers to the nation in which the imported goods were produced, grown, or manufactured. For goods made in multiple countries, the country in which the goods were last significantly transformed should be listed as the country of origin on the form.

Importer Number

CBP Form 7501 requires the unique reference number of the person or business importing the goods into the United States. US citizens can simply add two zeros to the end of their tax ID number to create their importer number. If you have imported into the US before, your importer number will be on a commercial invoice.

Description of Merchandise

The form and its continuation pages allow the importer to include detailed information about the nature of the goods they’re importing into the United States. This can include the weight, volume, and dimensions of the goods, as well as their value.

The Role of CBP in US Imports

The US Customs and Border Protection (CBP) team takes responsibility for helping lawful trade take place between international businesses. They inspect commercial goods arriving in the United States and apply and collect duties on those imports if applicable.

All imports into the US must comply with US law. Form 7501 helps customs officials at the port of arrival assess whether that is the case with each consignment. Other trade-related responsibilities of the CBP include:

- Enforcing rules and regulations that apply to the import of commercial goods into the US

- Informing shippers and carriers about those laws, rules, and regulations and providing guidance when required

The Difference Between Form 7501 and Form 3461

Both forms are used for imports to the United States. CBP Form 3461 is a less detailed form that can be emailed to customs authorities to secure the release of goods to the consignee before the more thorough Form 7501 is completed. Importers have up to 10 business days following the date of the import to submit the entry summary form to US customs.

CBP Form 7502—One of Several Critical Shipping Documents

While it might seem like the shipping industry is awash with forms, each serves a specific and important purpose. CBP Form 7501 gives customs officials in the United States detailed information about the nature of imported goods. It allows them to assess the legality of the freight and whether import duties are payable.

Like other customs documents, this form helps businesses operating within the law gain access to the lucrative US market. It’s also a vital element of the CBP’s remit to thwart those who would bend or break customs rules.