What are HS and HTS codes? A guide for international shippers

If a business ships internationally, it will need to comply with global and country-specific regulations. Two important requirements involve Harmonized System (HS) and Harmonized Tariff Schedule (HTS) codes. So what are HS and HTS codes?

HS and HTS code classifications ensure that goods move seamlessly across borders and comply with international policies. Without the proper HS, Schedule B, or HTS codes in place, businesses face serious penalties that have significant ramifications.

Harmonized system versus harmonized tariff schedule

Regulatory bodies established harmonized tariff code classifications to streamline and standardize trade data. The coding system not only determines the tariff or import duty rate for a product but also establishes a record of international trade in foreign trade zones. Countries use this data to develop international trade statistics for the products they import and export.

The HS code

An HS code is a six-digit product classification number that members of the World Customs Organization (WCO) use for international shipments. As of 2021, 183 countries are members of the WCO, including China, India, South Africa, the United Kingdom, and the United States. There are three parts of a standard HS code.

- The first two digits refer to the product’s chapter classification under the HS Nomenclature.

- The next two digits refer to the heading that the product falls under.

- The last two digits refer to the appropriate chapter subheading.

For example, if a business is shipping adhesive bandages, the HS code will be 3005.10. Chapter 30 of the HS Nomenclature refers to pharmaceutical products; heading 3005 refers to wadding, bandages, gauze, and similar articles; and section 3005.10 refers to adhesive dressings and other bandages with an adhesive layer.

The HTS code

HTS codes, on the other hand, are product classification codes that the United States uses to identify imports. The U.S. International Trade Commission administers HTS codes. These 10-digit product classifications have three key components.

- The first six digits of the HTS code refer to the product’s HS code.

- The next two digits identify the U.S.-specific subheading of the HS code or the HTSUS code. These digits establish the appropriate tariff rates.

- The last two digits do not classify the product. Instead, they refer to a statistical suffix that collects trade data. If the suffix is not a requirement, these additional digits are 00.

For example, say that a business is shipping adhesive bandages to the United States and these bandages have an antibiotic coating. Its HTS code will be 3005.10.1000. The first six digits compose the appropriate HS code, while the next two digits refer to the appropriate subheading within the HTS. Since the U.S. government does not require statistical data for these products, the final two digits are 00.

Schedule B and GHS codes

The Schedule B code is another type of classification developed by the United States Census Bureau, Division of Foreign Trade. Unlike HTS codes, which concern imports, Schedule B codes are a requirement for exports. U.S. businesses will need to include the Schedule B code when they ship goods to other countries. The Schedule B number is the same as the HTS code.

Another classification is the Globally Harmonized System of Classification and Labelling of Chemicals (GHS). GHS codes are necessary for chemical shipments, such as pharmaceutical and manufacturing products. Developed by the United Nations, GHS codes are unique to the product. Businesses shipping chemicals must include the GHS code in addition to the HTS or HS number.

The purpose of the HTS and HS tariff code

The primary purpose of a product code is to standardize and streamline international trade. By creating a unified system to classify specific goods, border officials better understand shipments and therefore levy the appropriate tariff. HS number analysis also provides countries with key insights into international markets, which inform trade policy decisions.

Businesses also use harmonized tariff schedule data to drive supply chain decisions, as well as assess domestic and international demand. However, it is the responsibility of the business—or its third-party logistics provider—to identify the correct HTS, Schedule B, or HS code. The business must also prepare the shipment according to international regulations, such as storing pharmaceutical products at the correct temperature or using appropriate materials for toxic chemicals.

To ship internationally, businesses need the right HS code. Without the appropriate HS, Schedule B, or HTS number, a company faces serious penalties with potentially business-impacting consequences. Heavy fines, loss of shipping privileges, and the overpayment of fees and tariffs are common with incorrect product classifications.

How a customs authority uses the HTS or HS number

Customs officials use the HTS code in several ways. One of the most vital functions of the HTS or HS system is to identify the appropriate customs tariff. Border officials also use the HS or HTS number to prevent banned or hazardous products from entering their countries.

For businesses, failure to correctly classify products contributes to disruptions and may affect profit margins. Some consequences of incorrect HS, Schedule B, or HTS codes include:

- Overpaying or underpaying required tariff or customs duty

- Expensive noncompliance penalties at the importing or exporting country

- Lengthy border delays that disrupt the supply chain and extend fulfillment times

- Seizures of goods by border officials

- A revocation of a business’s import and export privileges

- The loss of important duty drawbacks or export incentives, which businesses have a right to claim

For best results, companies should outsource HS or HTS classification to a third party. Working with an international logistics provider removes the burden of code identification from the business. Using a reputable service helps businesses avoid these penalties and move goods seamlessly around the globe.

Where to find an HS or HTS code

After gaining an understanding of HS and HTS codes, a business must identify the correct HS or HTS classification before it ships a product. Choosing the right commodity code may seem complicated, but correct identification will help businesses avoid too-high tariff rates or customs penalties.

If a business needs an HS code, it will need to refer to the WCO Trade Tools website and accompanying search engine. For HTS classifications, businesses will need to go to the U.S. International Trade Commission website. A business is able to confirm a Schedule B code on the U.S. Census Bureau website.

Businesses use these resources to navigate the international harmonized system. For each product that a business ships, the company’s shipper, freight forwarder, or customs broker will need to identify the following information.

- First, the broker will need to identify the product’s fundamental purpose. If a product has multiple uses, the company will need to choose either the most important or the most valuable use.

- Next, the broker will need to look at the appropriate chapter of the HS, Schedule B, or HTS code. The broker then ensures the product is in the relevant chapter.

- Once the broker confirms the correct chapter, they will need to locate the subheading and end-use descriptions to identify the appropriate HS classification.

- If the product requires an HTS or Schedule B code, the broker will then need to review the applicable tariff rate requirements.

With this information, the company or logistics provider can correctly complete the proforma invoice, packing list, commercial invoice, and other important shipment documents. This helps the business navigate customs clearance and avoid hefty penalties or delays. In turn, this efficiency delivers more value to the end customer.

Work with a reputable third-party logistics provider

Complying with harmonized code regulations is necessary for international shipping, and knowing the difference between HS and HTS codes streamlines the process; however, failure to place the proper code on a shipment puts the entire business at risk. Shipping compliance is lengthy, complicated, and highly specialized—and businesses need an international expert on their side.

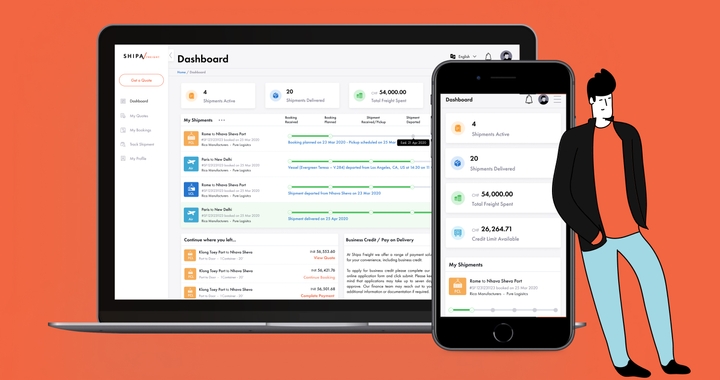

Businesses searching for a reputable logistics provider turn to Shipa Freight. Equipped with advanced shipping technology and a team of global experts, Shipa Freight has the tools businesses need to connect with international markets. Contact Shipa Freight today to learn more about logistics solutions.

Why Ship With Shipa Freight?

Shipa Freight can assist you in making your shipment easy and hassle-free. We have access to the best freight forwarding platforms that can greatly benefit your shipping experience.

Shipa Freight has expert staff and the latest logistics technology to help you with your shipment needs. With our expertise, we can guarantee seamless and hassle-free shipping for you. We also provide you with assistance with HTS Codes so that you can get your cargo faster and without complications.

If you need to ship cargo, choose Shipa Freight for easy and stress-free shipping.